Contents

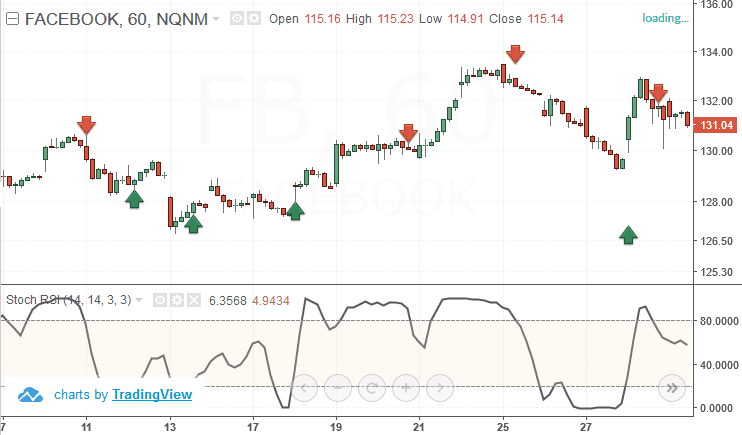

This is similar to the island reversal pattern, which is visible in bar charts and is more powerful than the morning/evening star patterns. This script highlights https://1investing.in/ modified version of evening and morning star candlestick patterns. Volume has also been added in the script to create convergence of volume with price action.

The confirmation comes on the third day, when the market opens lower and keeps falling during the day, which results in a long-bodied red candle. When these candlestick patterns are backed up by volume and other technical indicators like resistance level, then it confirms the signal. Sometimes, the evening star pattern is a brief shift from an upward trend to a downward trend in a predominantly downward trend line. The brief uptrend is usually visible only upon close scrutiny. However, it represents short-lived control of the bulls at this point in a bearish market space.

The pattern is created when there is a long green/bullish candle followed by a small red/bearish candle, and then finally, a long red/bearish candle. The evening star candlestick pattern can be found across all timeframes but is most commonly seen on longer timeframes such as the daily chart. When interpreted correctly, this formation can be an extremely powerful tool for traders.

The trade setup for Evening Star is as follows:

Trade Setup – Evening Star PatternAs soon as you see the evening star pattern on the chart. You have to wait for the breakdown of the low of the bullish candle. However, the star patterns aren’t the only Total Return Swap patterns used to identify trend changes. Traders also use bullish or bearish harami candlesticks to understand market movements. The evening star is a strong indicator that a downward trend has started.

- When the third candlestick opens below the body of the star candle, the pattern is considered to be more reliable.

- The second candle leaves a gap with the previous large candle.

- The chart shows an example of the Evening star pattern in a chart.

- A bullish harami appears when a large red candle appears in a downtrend.

- Type in the number of stocks or the lot size that you want to bid on.

- On the third day of the pattern , the market/stock opens a gap up followed by a blue candle that closes above the red candle opening of P1.

You might expect the price to drop when you borrow at a high price. On the other hand, little price movement is characterized by short candlesticks. The pattern is mostly used under technical analysis to identify when a trend is about to reverse. The first candle must be a bullish candle showing continuation of the existing uptrend.

Used for describing a wide variety of market trends these patterns are consulted frequently by technical traders. But it requires skills and detail understanding to be able to interpret candlestick patterns. In this article, we will discuss the evening star candlestick pattern and how to interpret it in a chart. The morning star pattern is the exact opposite of the evening star pattern. It appears in a downtrend indicating the trend reversal.

The Morning Star

This is a daily chart of the COAL INDIA NSE stock chart. All the characteristic patterns are present in this chart. But I should also mention that this type is not a very common sight.

However after the encouraging open the market/stock does not move, and sees a selling pressure. On the 3rd candle of the pattern, the market opens gap down and progresses into a red candle. The long red candle indicates that the bears are taking control. However, the probability of success increases if the other technical conditions also coincide with it. So, in case of high volume, along with the third candle, this pattern is formed at major supports/resistance levels, etc.

But, after this excitement, the market/stock does not move and closes by forming a Doji/Spinning Top. This poor close of P2 makes the bulls a little nervous. The Evening Star pattern is a triple candlestick pattern that usually occurs at market tops and the Morning Star pattern is a triple candlestick pattern that occurs at market bottoms. This candlestick pattern is also easy to identify as they happen frequently in the charts. When you are looking to set an evening star pattern target, there are a couple of rules you may follow.

You must register using your email and phone number if you don’t already have an online account. Stock Trading is business, the success depends not just on capital or subscribing advisory services or participating workshops. Candlestick analysis are a simple and powerful tool to understand the market movement. The stoploss for this trade will be the highest level of P1, P2, and P3. P2 should give a gap-up opening and form a doji or a spinning top. With the gap-down opening, P2 should be either a doji or a spinning top.

Popular in Markets

Three government-owned banks and one owned by Life Insurance Corp continue to be in a bad shape. At least 10 public-sector banks are busy with their consolidation plans. The answer will have to wait, writes Tamal Bandyopadhyay.

The high and low prices are not near the opening and closing prices. A bearish candlestick on day 2 speaks a lot more about bulls weakness. If the third candlestick opens below the actual star, leaving a space between the actual star and the third candlestick, the evening star’s accuracy is improved. The pattern is more dependable if the volume on the first candlestick is lower and the volume on the third candlestick is higher, therefore volume should also be taken into account. The market opens with a gap down and proceeds into a red candle on the third day of the pattern .

Candlestick Analysis

It’s difficult to spot these candlestick patterns in a trending market. However, when the market is consolidating or highly volatile, such formations can ably assist in identifying trend reversals in advance. Stocks with such reversal patterns have seen a stable surge from a medium-term perspective.

As seasoned traders, we simplify the trading process for our clients to avoid confusion and losses. To ensure that our trading strategy is effective, it’s always recommended to mix and match the patterns and indicators. One side of this triangle is the line representing the existing uptrend and the other side is the line representing the upcoming downtrend. Evening Star is a combination of candlestick three candlesticks. This pattern, consisting of three candlesticks, can be seen in the chart.

The three candlestick patterns that we will study are the Morning Star and the Evening Star. Before we understand the Morning Star pattern, we need to understand two common principles of price movement – the gap up opening and the gap down opening. A gap is a common movement of price movements in the market.

This candlestick pattern is also easy to identify as they occur frequently in the charts. Please note that your stock broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days. It must be kept in mind that the Evening chart is not the only bearish reversal indicator. There are other indicators that must be looked into for confirmation of the trend.

After the trader is assured of the trend reversal, he/she initiates a short/ sell trade just below the third candle of the evening star pattern on the next day. The evening star candlestick pattern is a three-candlestick pattern that signals the reversal of an uptrend. The morning star candlestick pattern is a three-candlestick pattern that signals the reversal of a downtrend. Opposite of an evening star candlestick pattern is the morning star candlestick pattern, which is considered as a signal for reversal of a downtrend.

The second candlestick is the star, which has a short real body that is separated from the real body of the first candlestick. The gap between the real bodies of the two candlesticks distinguishes a star from a Doji or a spinning top. More is the indecision on star candlestick, more are the chances of trend reversal.

D) The third day should open higher compared to the previous day’s close and continue to move up, ending the day with a long-bodied green candle. Identifying the Morning Star on charts involves more than simply identifying the three main candles. What is required, is an understanding of previous price action and where the pattern appears within the existing trend. When the third candlestick opens below the body of the star candle, the pattern is considered to be more reliable. In the situation, which is rarely witnessed, a gap is formed between the body of the star and the body of the third candlestick. The evening star pattern is a control shift from the bulls to the bears.

About different candlestick patterns what it shows at what positions and when it is advisible to buy and sell… My name isGaurav Heera, Founder of Delhi Courses Academy, a technical analyst, writer & blogger with ten years of experience in the industry. In my years in share market, I have acquired the skills to make every project I undertake a roaring success. Analysis comes to me naturally, and over the years I have formalized the process to achieve unfettered success in the technical analysis landscape. My process involves bringing simple ideas to a conceptual level and taking these concepts to an analysis level. For me, satisfaction is adapting to new ways to achieve success.